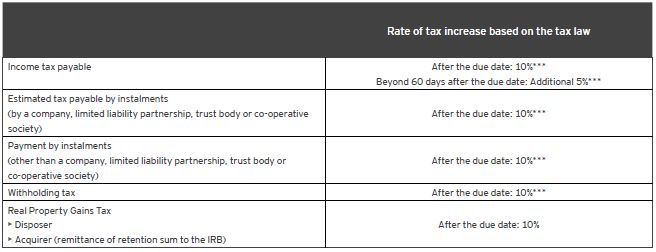

Shares In Real Property Company RPC Procedures For Submission Of Real Porperty Gains Tax Form. Late payment of tax is subject to an interest penalty which will be calculated from the tax underpayment and using the interest rate published by the Ministry of Finance MoF on a monthly basis calculated from the payment due date.

SST Registration in Malaysia.

. For the 21 offenses with no intention of fraud or tax evasion. Number of Late Days. Income Tax Payment other than instalment scheme 4.

IRAS will issue a Notice of Assessment if you do not file your annual tax returns before the deadline. Payment for Section 108. Quranism or Quraniyya Arabic.

Malaysia Company Incorporation Services. Advance tax payments done until 31st March of the year should be 100 of your total tax payable. Penalty Payment For Section 108.

Amending the Income Tax Return Form. If it exceeds more than 3 months after the deadline the penalty will be S600. ACRA and IRAS take non-compliance seriously.

Investigation Composite Advance and Instalment Payment. If a company files their annual return 3 months after the deadline the late filing penalty will be S300. Tax Estimation Advance Payment.

SST Penalties and Offences in Malaysia. SST Return Submission and Payment. Interest under Section 234B and Section 234C is applicable when you dont pay your advance tax.

Youll get a penalty if you need to send a tax return and you miss the deadline for submitting it or paying your bill. Form used by company to declare employees status and their salary details to LHDN Deadline. To avoid Interest Penalty under Section 234B and 234C Pay advance tax when your tax liability in a year is Rs.

Penalty Payment For Composite. Form B Income tax return for individual with business income income other than. Submission Of Sales Tax Returns.

Also known as Quranic Islam is a branch of IslamIt holds the belief that traditional religious clergy has corrupted religion and Islamic guidance should be based strictly on the Quran thus opposing the religious authority of all or most of the hadith literature and extra non-Quranic texts. Accordingly penalty for late remittance will not be imposed. In this respect the sales tax incurred by the licensed manufacturer.

Corporation tax claims and elections Deadline for action. Hence late filing of GST return will have a cascading effect leading to heavy fines and penalty see below. 31032022 30042022 for e-filing 4.

Basis Period for Company. Tax Monthly Instalment Payment Balance of Tax - Company. The penalty for late filing of the annual tax return is IDR100000.

Goods and Person Exempted from Sales Tax. Such entities with a 30 June 2021 accounting period end should ensure their 2021 corporation tax return is filed by 30 June 2022 to avoid late filing penalties starting from 100. Penalty on Late Payment.

Form BE Income tax return for individual who only received employment income Deadline. Penalty Payment For Section 103A 103. Youll pay a late filing penalty of 100 if your tax return is up to 3.

An offender not paying tax or making short payments must pay a penalty of 10 of the tax amount due subject to a minimum of Rs. Change In Accounting Period. Section 26 of the Sales Tax Act 1972 stipulates that directors partners are jointly and severally liable for the sales tax payable by the company firm as the case may be.

30042022 15052022 for e-filing 5. Extension of time to file the annual.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Why Incorporate In Delaware Silicon Valley Bank

Form 5471 Top 6 Reporting Challenges Expat Tax Professionals

Sec Filing Atai Life Sciences N V

Brand Ambassador Contract Template Pdf Templates Jotform

Can T Pay Corporation Tax On Time Corporation Tax Arrears Aabrs

File Accounts Later With A Companies House Filing Deadline Extension Freshbooks Blog

When To Consider A Protective 1120 F Filing Expat Tax Professionals

:max_bytes(150000):strip_icc()/dotdash-career-advice-investment-banking-vscorporate-finance-Final-6c88b378459d43fabfc4474e194bcb29.jpg)

Investment Banking Vs Corporate Finance What S The Difference

How To Write An Employment Termination Letter Covid 19 Templates Included Comeet

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Reporting Of Foreign Corporations Expat Tax Professionals

Pfic Reporting On Form 8621 Expat Tax Professionals

Tax Amnesty Waiver And Remission Of Tax Penalty Withholding Tax Malaysia

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)